Trading has always evolved alongside technology, but today the pace of change is reaching unprecedented speeds. With artificial intelligence (AI) and quantum computing gaining traction in the financial world, investors are starting to look beyond traditional tools. The emergence of platforms like quantumxtradingbot.com is a clear signal that the next era of trading is already underway.

These innovations promise not just incremental improvements, but fundamental shifts in how decisions are made, how quickly markets are analyzed, and how investors interact with their portfolios. At the core of this transformation is the idea of automating complexity—offloading thousands of micro-decisions per second to systems that never sleep and never blink.

From Manual Monitoring to Intelligent Automation

Most investors are familiar with setting alerts, analyzing charts, and reacting to news. But in an environment that moves in milliseconds, even the sharpest human mind has limitations. That’s where AI-enhanced platforms are beginning to make a difference.

By using machine learning algorithms that continuously evolve with market data, these systems can identify patterns and execute trades automatically—removing emotion from the equation and focusing purely on statistical probabilities. In practice, this means a trading bot can make hundreds of adjustments per day, each based on thousands of data points, without fatigue or hesitation.

Quantum X, for instance, integrates real-time data processing with automated strategies that adapt as conditions shift. It’s not just about speed—it’s about intelligence. The platform doesn’t simply execute pre-programmed rules; it learns and recalibrates.

The Role of Quantum-Inspired Algorithms

Quantum computing, still in its early stages, introduces possibilities that go far beyond classical computation. While few trading platforms truly run on quantum hardware today, many—including Quantum X—use what are called quantum-inspired algorithms. These simulate some of the key principles of quantum computing on traditional infrastructure.

Why does this matter for investors? Because such algorithms can handle massive datasets and complex variables simultaneously, enabling models that analyze correlations, market trends, and anomalies with a level of precision that older systems can’t match.

The result: faster, more accurate forecasts and an improved ability to seize fleeting opportunities in volatile markets.

Security and Trust in the Age of AI

With increased automation comes increased concern—especially around security. Entrusting a bot with your financial data and decision-making requires a system that’s robust, transparent, and reliable.

Quantum X emphasizes end-to-end encryption, continuous monitoring, and intelligent threat detection. According to their official website, their infrastructure is built around modern cybersecurity protocols, aiming to provide users with peace of mind while using AI and automation.

This is particularly important as AI platforms become more popular. The risk of scams or poorly secured software grows alongside innovation, making it essential to evaluate not just the performance of a tool, but also its safeguards.

Designed for All Levels of Traders

One of the most promising features of next-generation platforms is accessibility. You don’t need to be a data scientist or a professional day trader to benefit from AI-enhanced systems.

Many of these tools are designed with user experience in mind. Quantum X, for example, provides a streamlined interface available on both desktop and mobile. That means traders can execute decisions or monitor performance from anywhere—without needing to sift through complex dashboards or manually analyze charts.

This accessibility opens up advanced trading tools to a much broader audience, potentially leveling the playing field between institutional and retail investors.

Automation Without Oversimplification

There’s a common misconception that automation removes the need for human involvement altogether. But in reality, the best AI trading platforms are not about replacing the investor—they’re about enhancing the investor’s capabilities.

Systems like Quantum X allow users to set preferences, define parameters, and remain in control of their capital. Automation takes care of the technical execution, but strategy remains in the hands of the user.

This hybrid approach—where humans define the vision and AI handles the execution—is likely to be the dominant model in years to come. It offers the best of both worlds: human intuition and machine precision.

Real-Time Decision Making at Scale

One of the main advantages of AI in trading is its ability to process and react to information faster than any human could. While traditional investors might wait for a news alert or a chart signal to act, AI systems monitor dozens of markets and thousands of indicators simultaneously, responding in milliseconds.

This is particularly important in high-frequency trading environments or during periods of market volatility. Quantum X’s framework, for example, is designed to minimize latency through advanced infrastructure and predictive algorithms. This allows the system to execute trades not only faster—but smarter.

The combination of speed and contextual analysis means AI can spot subtle shifts in sentiment or momentum long before they become obvious to the broader market.

The Democratization of Sophisticated Tools

In the past, advanced trading algorithms were largely the domain of hedge funds and institutional investors with access to expensive infrastructure and in-house engineering teams. That barrier is quickly disappearing.

Today, retail investors can access quantum-inspired strategies, automated bots, and predictive AI tools with just a few clicks and a modest deposit. Platforms like Quantum X are at the forefront of this shift, offering a blend of institutional-grade technology and retail accessibility.

What this means is that investors with limited experience or capital can now compete with more established players—not by working harder, but by working smarter.

How Investors Are Responding

User feedback has played an important role in the development of AI trading platforms. As adoption grows, traders are beginning to see tangible results in areas such as:

- Risk mitigation: Bots help reduce emotional decision-making.

- Time savings: Automated systems work 24/7 without human supervision.

- Performance consistency: Adaptive algorithms refine strategies over time.

- Peace of mind: Real-time monitoring and smart alerts enhance confidence.

Numerous testimonials from Quantum X users cite significant improvements in trade execution, reduced stress, and better alignment between investment goals and actual performance. For many, the shift to AI trading isn’t just about technology—it’s about a more sustainable and efficient way to manage wealth.

Mobile-First, Globally Available

Accessibility isn’t just about design; it’s also about availability. Platforms like Quantum X are fully web-based and offer apps for Android and iOS, making them suitable for on-the-go decision making.

More importantly, they are open to users across continents—from Canada and the United Kingdom to parts of Europe, Asia, and beyond. This global reach helps create a diverse user base, which in turn supports continuous improvement of the system as more data is gathered from different markets and conditions.

Regulatory Considerations and Responsible Use

As with any disruptive technology, there are ongoing discussions about how to regulate AI and automated trading systems. Investors should always take the time to understand the legal landscape in their country and ensure any platform they use complies with relevant financial laws.

While tools like Quantum X offer powerful functionality, responsible use still matters. It’s essential to:

- Research the platform’s terms of use and privacy policy.

- Use demo modes when available to test before committing funds.

- Set realistic expectations—AI enhances strategy, it doesn’t guarantee profits.

The role of the user is not diminished by automation; rather, it’s elevated to one of strategic oversight, where critical thinking and good judgment are key.

What Sets Quantum X Apart

Among the growing number of AI trading tools available today, Quantum X stands out in several ways:

- Quantum-inspired algorithms: These offer a blend of speed and depth in analysis, inspired by quantum computing principles.

- Security-first architecture: Built with encryption and live monitoring systems to protect user data and funds.

- Adaptive strategies: The platform refines its decision-making as market conditions evolve.

- Intuitive interface: Designed to be used by beginners and experts alike.

- Transparent onboarding: No hidden fees, with clear signup steps and low entry thresholds.

This combination helps position the platform as more than just another trading tool—it becomes a comprehensive ecosystem for modern investing.

Understanding the Difference: AI Trading vs Traditional Investing

As more platforms adopt AI, it’s worth asking: how does this approach differ from the investment methods most people are used to?

Traditional investing often involves manual research, periodic portfolio reviews, and slower reaction times. Investors rely on financial news, economic reports, and personal judgment to guide decisions. While this can be effective, it has limitations—especially in fast-moving markets.

By contrast, AI trading platforms operate in real-time, analyzing thousands of data points simultaneously and acting instantly on statistical signals. They don’t replace traditional methods entirely, but they do introduce:

- Speed: Reactions measured in milliseconds.

- Scale: The ability to analyze multiple assets and trends at once.

- Consistency: Emotion-free execution based on predefined logic.

For investors over 35—who may be more familiar with traditional brokerage models—understanding these differences is key to embracing a hybrid strategy that blends human oversight with technological precision.

A Glimpse Into the Future of Investing

As AI continues to improve and quantum technologies mature, the gap between human intuition and machine execution will narrow. We are entering a time when real-time data analysis, predictive modeling, and adaptive systems will become the norm rather than the exception.

In this landscape, investors who embrace new tools—not as shortcuts, but as strategic amplifiers—will have a distinct advantage.

The rise of platforms like Quantum X signals not just a technological shift, but a mindset shift. It challenges traditional assumptions about control, timing, and analysis in the financial world. And it opens the door to a more agile, informed, and inclusive investment culture.

Más noticias:

GobiernoSe llevará a cabo una nueva edición del «Festivalito»

Accidente en ChileViolento vuelco en Onaisin: una familia de Río Grande hospitalizada

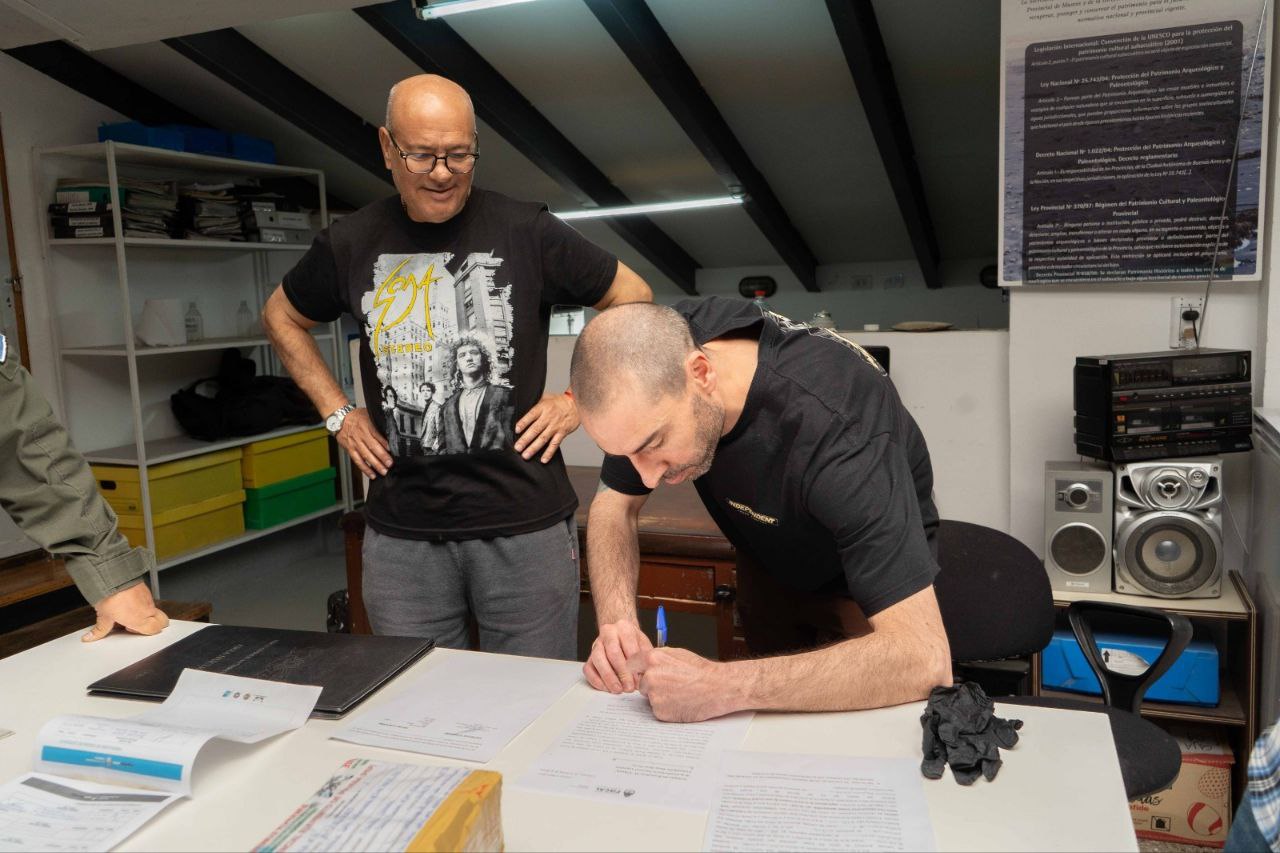

Ushuaia Museo del Fin del Mundo recuperó una reliquia arqueológica que había sido robada

Total aceptación El Patio Gastronómico de Río Grande debutó con todo

Río GrandeLlega el taller de «Galletas decorativas» al Paseo Canto del Viento

Comentarios